Your credit score is a three-digit number that tells lenders whether they can trust you to repay borrowed money. In Australia, scores range from 0 to 1,200 depending on which credit bureau calculates it: Equifax, Experian, or Illion. A good score opens doors to better loan approvals and lower interest rates, while a poor score can mean rejections or unfavourable terms. Understanding how your score works, what impacts it, and how to check it gives you control over your financial future.

This might be the first time you’re thinking seriously about your credit score. Maybe you’ve been declined for a loan, or you’re planning to buy a home soon. You’re not alone in feeling confused or worried about what your number means. The good news is that credit scores make sense once you understand the basics, and they’re not as mysterious as they seem.

Key Takeaways

- Australian credit scores range from 0 to 1,200 (Equifax) or 0 to 1,000 (Experian and Illion), with ratings from “Below Average” to “Excellent”

- Your score is shaped mainly by repayment history (35 to 40% weight), how much credit you use, how often you apply for credit, account age, and account variety

- You can check your credit report for free every three months from Equifax, Experian, or Illion.

- Checking your own score doesn’t hurt it; only lender reviews when you apply for credit cause temporary drops.

- Buy Now Pay Later services will now report to credit agencies from January 2025, affecting your credit history.

- The Privacy Act 1988 and the National Consumer Credit Protection Act govern credit reporting and protect Australian consumers.

- The average Australian credit score in 2025 sits around 725 to 855, placing most consumers in the “Good” to “Excellent” range.

- Negative listings like defaults stay on your report for up to five years, but gradually lose impact with good behaviour.

What Exactly Is a Credit Score in Australia?

A credit score is a number that represents how reliably you manage credit and debt. If you’ve ever wondered who decides your credit score in Australia, it’s three main credit reporting agencies: Equifax, Experian, and Illion. These agencies collect information about your borrowing and repayment behaviour, then assign a number that lenders use to decide whether to approve your applications and what interest rates to offer.

Your credit score works by tracking patterns in how you handle money you’ve borrowed. Do you pay bills on time? Do you max out credit cards? How often do you apply for new credit? All these behaviours get recorded and calculated into your score.

Australia follows a system called Comprehensive Credit Reporting (CCR), which tracks both positive and negative data. This means your score reflects not just missed payments or defaults, but also your on-time payments, types of credit accounts, and how long you’ve held them. The CCR system came into effect in July 2018 and was designed to give lenders a more balanced view of your financial habits. Before CCR, credit files only showed negative information like defaults and missed payments. Now, lenders can see your full payment history, which helps responsible borrowers demonstrate their reliability.

Here’s why your credit score is important: lenders check it when you apply for credit cards, personal loans, car loans, or home mortgages. A higher score signals that you’re a lower-risk borrower, which can result in faster approvals, higher credit limits, and lower interest rates. Different lenders have different cut-offs for what they consider “good,” so even small score differences can affect your borrowing terms.

The credit reporting system in Australia has evolved significantly over the past decade. Credit providers now rely on credit checks for most mainstream consumer lending applications, which can be conducted more quickly than ever before and in many cases entirely electronically. This technological advancement has made the lending process faster and more efficient, but it also means that your credit history is scrutinised more thoroughly than ever.

You might have the same score with Equifax, Experian, and Illion, or you might have different scores from each bureau. Not all lenders report to every agency, so the information each one holds about you can vary. This is why checking all three bureaus before a major application gives you the complete picture of what lenders will see.

What Is a Good Credit Score in Australia?

Wondering what’s considered a good credit score in Australia right now? Credit scores vary by bureau, but all three agencies use similar rating categories to classify your score. Here’s how the ranges break down:

Equifax (Score Range 0 to 1200):

- Below Average: 0 to 459

- Average: 460 to 660

- Good: 661 to 734

- Very Good: 735 to 852

- Excellent: 853 to 1200

Experian (Score Range 0 to 1000):

- Below Average: 0 to 624

- Good: 625 to 699

- Very Good: 700 to 799

- Excellent: 800 to 1000

Illion (Score Range 0 to 1000):

- Below Average: 0 to 499

- Average: 500 to 699

- Good: 700 to 799

- Very Good: 800 to 899

- Excellent: 900 to 1000

A “good” score means you have a history of consistent, reliable repayments and responsible credit use. Lenders see you as trustworthy, which increases your chances of approval and access to competitive rates. Keep in mind that different lenders have their own thresholds. Some banks may require higher scores for home loans compared to personal loans due to the larger amounts involved.

Your score isn’t fixed. It changes based on your financial behaviour. What’s considered “good” can vary depending on the type of credit you’re applying for. A score that’s good enough for a credit card might not meet the standard for a home loan, where lenders typically look for higher scores and more stable credit histories.

If you’re asking yourself how high your credit score needs to be for a home loan, most lenders look for at least 700 or higher. Some lenders may approve applications with scores in the mid-600s, but you’ll likely face higher interest rates and stricter conditions. The higher your score, the better your chances of securing competitive rates and favourable loan terms. A score above 750 typically provides access to the best interest rates, which over a 30-year mortgage can save you tens of thousands of dollars.

In 2025, more Australian lenders are using open banking data to supplement traditional credit scores. This provides a broader view of your finances beyond simple repayment history, including your income patterns, spending habits, and savings behaviours. With your consent, lenders can access this granular data through open banking systems, which can sometimes work in your favour if you have temporary blips in your traditional credit score but maintain strong overall financial health.

What Is a Bad Credit Score and How Do You Fix It?

A bad credit score in Australia typically falls below 550 to 660, depending on the bureau. Scores in this range are classified as “Below Average,” “Fair,” or “Room for Improvement,” and they signal to lenders that there may be issues with your credit history. Common reasons for low scores include missed or late payments, defaults, high debt levels, or too many credit applications in a short period.

If you’re worried about what happens if your credit score is below 600, here’s the reality: lenders see low scores as higher risk. This can lead to loan rejections, higher interest rates, lower credit limits, or requirements for a guarantor or security deposit. A score of 520, for example, often indicates multiple defaults or serious credit infringements that make lenders hesitant to approve new credit.

This can feel frustrating, but you’re not alone, and progress is realistic. One person with a 520 score improved to above 650 within 12 months by making consistent on-time payments and correcting errors on their report. Rebuilding takes time and discipline, but it’s possible with the right actions and guidance.

People with poor credit scores often face real-world consequences beyond loan rejections. Landlords may check credit scores before approving rental applications. Some employers in financial services conduct credit checks as part of their hiring process. Utility companies might require higher security deposits from people with poor credit histories. These ripple effects make it clear that maintaining a healthy credit score affects multiple areas of your life, not just borrowing.

The fastest way to recover from a bad credit score is to start making all payments on time, every time. Even if you can’t pay off old debts right away, demonstrating consistent current payment behaviour shows lenders that your financial situation has improved. Most people see meaningful improvements within six to twelve months of changed behaviour, but complete recovery from serious defaults or infringements can take several years. The key is starting now and maintaining good habits even when progress feels slow.

How Credit Scores Are Calculated

Credit bureaus use similar factors to calculate your score, but they weigh them differently. Understanding what affects your credit score the most helps you see where you can make improvements.

Repayment History (35 to 40%)

This is the most influential factor, accounting for 35 to 40% of your score. It tracks whether you’ve paid bills, credit cards, loans, and rent on time over the past 24 months. Many people wonder if missing one payment really lowers their score, and the answer is yes. Even one missed payment can have a noticeable impact if you otherwise have a clean record. Late or missed payments can drop your score quickly and stay on your report for up to two years.

Your repayment history tells lenders the most important thing they want to know: do you actually pay back what you borrow? This is why it carries the heaviest weight in score calculations. Under the CCR system, every on-time payment is recorded and helps build your credit profile. Before CCR, only negative payment information appeared on credit files, which meant good payers received no benefit for their responsible behaviour.

The impact of a missed payment depends on several factors: how late the payment was, how recent the missed payment occurred, and your overall credit history. A single 30-day late payment will hurt less than multiple 60-day late payments. Recent late payments damage your score more than older ones from several years ago.

Credit Utilisation

Credit utilisation is the ratio of how much credit you’re using compared to your total available credit. Keeping this ratio under 30% is ideal. For example, if you have a credit card with a $10,000 limit, your balance should ideally stay below $3,000. High utilisation suggests you’re relying heavily on credit, which can be a red flag to lenders.

Many people don’t realise that utilisation is calculated across all your credit accounts combined. If you have three credit cards with $5,000 limits each, that’s $15,000 in total available credit. Keeping your combined balances below $4,500 (30% of $15,000) maintains healthy utilisation.

Some credit scoring models look at utilisation on a per-card basis as well as overall. Maxing out even one card can hurt your score, even if your overall utilisation is low. The safest approach is to keep all individual cards below 30% utilisation while also maintaining low overall usage. If you find yourself regularly using more than 30%, you have two options: request a credit limit increase (which reduces your utilisation percentage) or pay your balance multiple times per month instead of waiting for the due date.

Credit Applications (Inquiries)

Every time you apply for credit, it’s recorded as an inquiry. There are two types: soft inquiries, which don’t affect your score (like checking your own report), and hard inquiries, which do. If you’ve been asking yourself what the difference is between a soft and hard credit check, here it is: hard inquiries occur when a lender reviews your credit as part of an application process. Too many hard inquiries in a short time can signal financial stress and lower your score. Hard inquiries stay on your report for two years.

Rate shopping for specific loan types is treated more leniently by scoring models. If you’re shopping for a mortgage or car loan, multiple inquiries within a 14 to 45-day period (depending on the scoring model) are typically counted as a single inquiry. This allows you to compare rates without excessive score damage. But this protection doesn’t apply to credit card applications, which are each counted separately.

The impact of a single hard inquiry is usually small, typically 5 to 10 points, but the cumulative effect of many inquiries can be significant. More concerning to lenders is the pattern: someone applying for multiple credit products across different categories suggests potential financial desperation.

Credit Age

The length of time you’ve held credit accounts matters. Older accounts build trust because they demonstrate a longer track record of managing credit. You might wonder what happens if you close an old credit card account. Closing old accounts can shorten your credit history and potentially lower your score.

Your credit age is calculated two ways: the average age of all your accounts, and the age of your oldest account. Opening several new accounts in a short time will lower your average account age, which can temporarily reduce your score. This is one reason financial advisors often recommend against closing old credit cards, even if you rarely use them.

There’s a balance to strike here. An old account with a negative history might hurt more than help. But an old account with a positive payment history is valuable. If you’re considering closing an old account, think about whether that account represents your oldest credit history. If it does, keeping it open (even with minimal use) protects your credit age.

Account Variety

Having a mix of credit types, such as a credit card, personal loan, and utility account, shows lenders you can manage different kinds of credit responsibly. This variety contributes positively to your score.

Lenders like to see that you can handle both revolving credit (credit cards, where your balance and payments change each month) and instalment credit (fixed loans with regular payments). Someone who only has credit cards might be seen as less experienced than someone who has successfully managed credit cards, a car loan, and a mortgage.

But you shouldn’t open new accounts just to improve your credit mix. The small benefit from variety doesn’t outweigh the potential damage from unnecessary hard inquiries and new accounts. Account variety naturally develops over time as your financial needs change.

Defaults and Negative Listings

Defaults occur when you fail to make a payment for 60 days or more. They stay on your report for up to five years and can significantly lower your score. Serious credit infringements, such as bankruptcy or court judgments, remain on your report for up to seven years. If you’re concerned about how long defaults stay on your credit report, the standard answer is five years from the date listed, regardless of whether you pay them off.

A default is one of the most damaging items that can appear on your credit file. The moment a default is listed, your score can drop by 100 points or more. Lenders view defaults as strong evidence that you may not repay borrowed money, which makes them extremely cautious about approving new credit.

Paying off a default doesn’t remove it from your credit file. It stays for the full five years from the date it was listed, though it will be updated to show “paid” status. A paid default looks better than an unpaid one, but it still negatively affects your score. The only way a default can be removed earlier is if it was listed in error and you successfully dispute it. You can tell if your credit score is improving by watching defaults age. Older defaults have less impact, especially when followed by consistent good behaviour.

The Laws and Agencies That Shape Credit Reporting in Australia

Australian credit reporting is governed by strict laws designed to protect consumers. The Privacy Act 1988 regulates how credit information is collected, used, and shared. It makes sure that credit providers and credit reporting bodies handle your personal information responsibly and only for legitimate purposes.

The Privacy Act’s Part IIIA deals with credit reporting, establishing clear rules about what information can be included in credit reports, who can access that information, and how long different types of information can remain on file.

The National Consumer Credit Protection Act (NCCP Act) requires lenders to follow responsible lending practices. This means they must assess whether a loan is suitable and affordable for you before approving it. From January 2025, Buy Now Pay Later providers also fall under this act, requiring them to hold a credit license and conduct credit checks before extending credit.

If you’ve been wondering whether using a Buy Now Pay Later app affects your score now, the answer changed in January 2025. This regulatory change closed a significant loophole. Before 2025, BNPL services operated outside traditional credit regulations, which meant they didn’t check credit histories before approving accounts and didn’t report payment behavior to credit bureaus. Many consumers accumulated substantial BNPL debt without it appearing on their credit files. The new rules bring BNPL into the same system as credit cards and personal loans, providing better consumer protection and more accurate credit reporting.

The Australian Financial Complaints Authority (AFCA) handles disputes related to credit reporting. If you believe your credit report contains errors or unfair listings, you can lodge a complaint with AFCA for free, impartial resolution.

The Office of the Australian Information Commissioner (OAIC) enforces privacy compliance and oversees the Privacy (Credit Reporting) Code 2025, which is mandatory for credit providers and credit reporting bodies. The OAIC has the power to investigate complaints, conduct audits, and impose penalties on organisations that mishandle credit information.

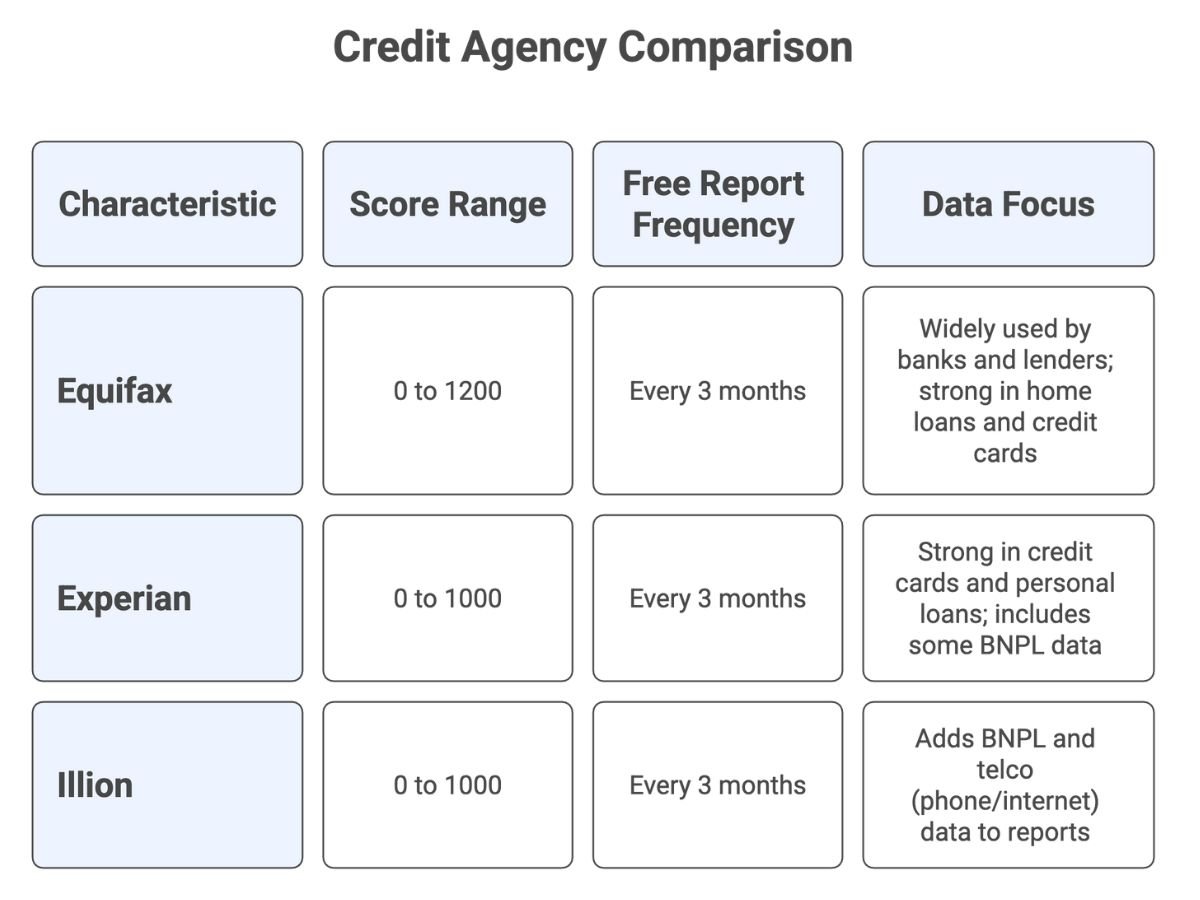

Credit Reporting Agencies Compared

Your score can differ across bureaus because not all lenders report to every agency. Some lenders only share data with one or two bureaus, so the information each agency holds about you may vary. This is why it’s useful to check your report with all three agencies if you’re planning a major credit application.

Each bureau uses slightly different scoring algorithms and weights factors differently. Equifax places more emphasis on certain factors compared to Experian or Illion. The differences are usually small for people with straightforward credit histories, but they can be more pronounced if you have complex situations like mixed positive and negative data.

How to Check Your Credit Score in Australia (Step-by-Step)

If you’re asking yourself how you can check your credit score for free in Australia, the process is straightforward, and you’re legally entitled to free access.

Step 1: Choose a Recognised Provider

You can access your credit report and score directly from Equifax, Experian, or Illion. Each bureau offers free reports every three months. You can request your report through their official websites: mycreditfile.com.au (Equifax), experian.com.au (Experian), or checkyourcredit.com.au (Illion).

Several third-party services also offer free credit score access, including Credit Savvy (powered by Experian), Credit Simple (powered by Illion), and Canstar (powered by Equifax). These services provide convenient access to your score along with monitoring features, but they may include advertising for financial products. Which site is best for checking your credit report safely? The official bureau websites are the most direct and secure option.

Step 2: Verify Your Identity

To access your report, you’ll need to provide identity documents such as your driver’s license or passport, proof of address, and your date of birth. This verification process makes sure that only you can access your personal credit information.

The identity verification process has become more sophisticated with digital identity systems. Some bureaus now offer verification through myGovID or other digital identity credentials, making the process faster and more secure. If you can’t verify online, you can submit a paper application with certified copies of identity documents.

Step 3: Review the Report Carefully

Once you have your report, look for outdated defaults, duplicate listings, incorrect payment history, or identity mismatches. Errors are more common than you might think, and correcting them can improve your score quickly. Here’s what you should look for when reviewing your credit report:

Check that all listed accounts actually belong to you. Identity theft can result in fraudulent accounts appearing on your credit file. Check that closed accounts are marked as closed. Verify that payment histories are accurate. Sometimes payments are incorrectly recorded as late even when you paid on time.

Look at the personal information section carefully. Incorrect name spellings, old addresses, or wrong date of birth information can indicate identity mix-ups or potential fraud. If you’ve changed your name (through marriage, for example), make sure both old and new names are correctly linked in your file.

Step 4: Understand Frequency of Checking

You’re entitled to a free credit report every three months. If you’ve been declined for credit, you can request a report within 90 days of the rejection at no cost. Many people ask how often they should check their credit report. Checking regularly, even monthly if you’re actively working to improve it, helps you catch errors early and track your progress.

Many financial advisors recommend checking your credit file at least once per year from each bureau, even if you’re not planning to apply for credit. This proactive approach helps you spot problems before they become urgent. If you’re planning a major credit application like a mortgage within the next few months, check all three bureaus to understand exactly what lenders will see.

What’s Inside a Credit Report (and Why It Matters)

Understanding what’s the difference between a credit score and a credit report helps you know what to look for. Your credit score is a number, but your credit report is the detailed document behind that number. Here’s what you’ll find:

Personal details include your name, current and previous addresses, date of birth, driver’s license number, and employment history. This information helps lenders confirm your identity and assess stability.

Repayment history shows records of payments made on credit accounts over the past 24 months. This section is the heart of your credit file under the CCR system. It shows whether you paid on time, late, or missed payments entirely.

Defaults and infringements list missed payments over 60 days, bankruptcies, court judgments, and other serious credit problems. Items in this section carry significant weight and can prevent credit approvals even if everything else in your file looks good.

Credit accounts detail current and closed credit cards, loans, and utility accounts. For each account, the report shows the credit provider, account type, credit limit or loan amount, opening date, and closing date if applicable.

Application history records when you’ve applied for credit (hard inquiries) over the past two years. Each entry shows the date, credit provider, and type of credit applied for.

Lenders pay close attention to your repayment history and any defaults or negative listings. They also look at how many credit applications you’ve made recently, as multiple applications can suggest financial difficulty.

What’s the Average Credit Score in Australia (2025 Data)

If you’re curious about what’s the average credit score in Australia in 2025, the current average sits around 725 to 855, placing most Australians in the “Good” to “Excellent” range. According to Equifax, the national average rose from 846 in 2022 to 855 in 2023, meaning the typical Australian now has an “excellent” score.

This improvement reflects several factors: better financial literacy, the positive impact of CCR showing on-time payments, economic stability, and government support programs during challenging periods.

Credit scores vary by age group. Younger Australians aged 18 to 30 have an average score of 731, which is the lowest among age groups, partly because they have shorter credit histories. People in their 30s and 40s typically have scores in the 750 to 850 range. Older Australians aged 61 to 70 have an average score of 935, reflecting decades of credit management experience.

Geographically, people in the Australian Capital Territory have the highest average score at 900, followed by Tasmania at 882. The Northern Territory has the lowest average at 825.

How Long Do Negative Listings Stay on Your Report

Default – 5 years

Serious credit infringement – 7 years

Hard inquiry – 2 years

Repayment history – 2 years

Negative listings don’t disappear right away once paid off. A default stays on your report for five years from the date it was listed, regardless of whether you’ve paid it. The same applies to missed payments and other negative entries.

The five-year default period is measured from the date the default was recorded, not from the date you eventually pay it. If a default was listed in January 2020, it will remain on your file until January 2025, even if you paid the debt in full in February 2020.

The aging of negative information works in your favour over time. A three-year-old default has less impact on your score than a three-month-old default. Recent negative entries hurt more because they suggest current financial problems. Older entries, especially when followed by years of positive payment history, tell lenders that you’ve moved past previous difficulties.

Common Misunderstandings About Credit Scores

“Checking your score lowers it”

This is one of the most common worries people have. Checking your own score is a soft inquiry and has no effect on your credit score. You can check as often as you like without any negative impact.

“Paying off debt removes defaults instantly”

Defaults stay on your report for up to five years even after you’ve paid them. Payment changes the status from “unpaid” to “paid,” which looks better to lenders, but doesn’t remove the listing.

“Closing old accounts improves your score”

Closing old accounts can shorten your credit history and potentially lower your score. It can also increase your credit utilisation ratio if you close credit cards.

“All credit bureaus have the same data”

Each bureau receives different reports from lenders, so your score can vary between Equifax, Experian, and Illion.

“Income affects your credit score”

Your income doesn’t directly appear in credit score calculations. Lenders will ask about your income during applications, but it’s not part of your score itself.

Real Stories: How Credit Scores Change Over Time

A person who missed three consecutive payments on a credit card saw their score drop by 90 points within three months. They had previously maintained a good score around 720, but the missed payments dropped them to 630. It took them six months of consistent on-time payments to recover 60 of those points. Full recovery to their previous level took about 14 months.

Another person paid all bills on time for 12 months without taking on any new credit. Their score increased by 150 points during this period, going from 625 to 775. When they applied for a car loan, they were offered an interest rate 2% lower than they would have received a year earlier, saving them thousands of dollars.

One individual discovered an incorrect default on their credit report during a routine check. They disputed the default with the credit bureau, providing payment records as evidence. The bureau investigated and removed the incorrect default within three weeks. Their score jumped by 120 points overnight, and they were approved for a mortgage they had previously been denied.

If Your Score Is Low: Start With These Three Steps This Month

Step 1: Get your free credit reports from all three bureaus

Visit mycreditfile.com.au, experian.com.au, and checkyourcredit.com.au. Request your free report from each. Set aside an hour to review them carefully. Look for errors, check that all accounts belong to you, and make a note of what’s hurting your score most. Is it defaults, late payments, or high credit card balances?

Step 2: Set up automatic payments for all current bills

Contact your bank and set up automatic direct debits for at least the minimum payment on all credit cards, loans, and bills. This makes sure you never miss another payment. If you’re worried about having enough money in your account, set the payment date for a day or two after you get paid.

Step 3: Start reducing credit card balances

Pick your highest-balance credit card and commit to paying more than the minimum each month. Even an extra $50 per payment helps. If you have multiple cards, focus on getting at least one below 30% utilisation. This creates visible progress and starts improving your score within a few months.

Simple Checklist: How to Read Your Credit Report Correctly

When you get your credit report, work through this checklist:

☐ Verify personal information: Is your name spelled correctly? Are all addresses yours? Is your date of birth accurate?

☐ Check all listed accounts: Do you recognise every credit card, loan, and account listed? Are closed accounts marked as closed?

☐ Review payment history: Look at the past 24 months. Do the on-time and late payment markings match your records?

☐ Look for defaults or court judgments: Are there any listings you don’t recognise or that seem incorrect?

☐ Check inquiry history: Do you remember applying for all the credit inquiries listed?

☐ Note anything unusual: If you see accounts, addresses, or inquiries you don’t recognise, write them down to dispute.

☐ Compare across all three bureaus: Are there discrepancies between your Equifax, Experian, and Illion reports?

How to Fix Errors on Your Credit Report

If you find an error, contact the credit bureau that has the error in its file. You can usually do this through their website. Explain the error clearly and provide evidence (like payment receipts, bank statements, or correspondence with the credit provider).

The credit bureau has 30 days to investigate your dispute. They’ll contact the credit provider who supplied the information and ask them to verify it. If the credit provider can’t verify the information or confirms it’s wrong, the bureau must remove or correct it.

If the credit bureau doesn’t fix the error or you’re not satisfied with their response, contact the credit provider directly. Explain the error and provide your evidence. Keep records of all communications.

If you still can’t get the error fixed, lodge a complaint with AFCA at afca.org.au. AFCA’s dispute resolution service is free and can investigate the matter impartially. They have the power to direct credit providers and bureaus to correct errors.

When to Seek Professional Help

You should think about professional assistance when you find errors or defaults you can’t dispute on your own. If you’ve contacted the credit bureau or credit provider directly without success, a credit repair service can help navigate the dispute process legally and effectively.

If your loan or credit card applications keep getting rejected despite maintaining good habits, there may be hidden issues on your report that you haven’t identified. Sometimes errors are subtle, like an old address linking you to someone else’s credit file, or a closed account incorrectly showing as open.

When you need legal or strategic guidance through Australia’s credit laws, working with a service that operates within the Privacy Act 1988 and the NCCP Act makes sure you’re protected and that any corrections are done lawfully.

Legitimate credit repair services focus on identifying and correcting genuine errors, helping you understand your rights under Australian law, and providing strategies for rebuilding credit through proper financial behaviour. They can’t legally remove accurate negative information, but they can make sure your credit file contains only information that should be there.

Easy Credit Repair helps Australians correct legitimate errors and restore credit accuracy through lawful, transparent processes.

Trusted Tools and Resources

You can access your credit report directly from these official sources:

Equifax: mycreditfile.com.au provides free credit reports and scores every three months, with options for paid monitoring services.

Experian: experian.com.au offers free reports quarterly and paid services for more frequent monitoring and identity protection.

Illion: checkyourcredit.com.au gives free access to your Illion credit score and report every three months.

The Australian government’s MoneySmart website (moneysmart.gov.au) offers free, impartial financial guidance and educational resources. MoneySmart provides calculators, guides, and information about credit, debt, budgeting, and financial planning.

The Office of the Australian Information Commissioner (oaic.gov.au) provides information about your privacy rights, including credit reporting rights.

The Australian Financial Complaints Authority (afca.org.au) offers free dispute resolution services if you can’t resolve credit reporting problems directly with the credit provider or bureau.

How to Keep a Strong Credit Score (Once You’ve Built It)

Always pay bills, loans, and credit card balances on time. Even one late payment can lower your score and stay on your report for two years. Set up automatic payments or calendar reminders to make sure you never miss a due date.

Keep your credit utilisation below 30% of your available limit. If you have a $5,000 credit card limit, aim to keep your balance under $1,500. If you regularly use more than 30%, think about requesting a credit limit increase or paying your balance multiple times per month.

Limit new credit applications. Each hard inquiry can temporarily lower your score, and multiple applications in a short period signal financial stress to lenders. Before applying, research whether you’re likely to be approved based on the lender’s typical requirements.

Review your credit reports regularly to catch errors, outdated listings, or signs of identity theft early. Free reports are available every three months from all three bureaus.

Keep old accounts open when possible. Older accounts contribute to a longer credit history, which benefits your score. If you have a credit card you rarely use, make a small purchase every few months and pay it off right away.

Avoid joint credit with unreliable partners. If someone you’ve co-signed with misses payments, it affects your score too. Only enter joint credit arrangements with people whose financial reliability you trust completely.

Pay attention to small debts. An unpaid $50 phone bill can become a default if it goes 60 days overdue. Small debts sometimes slip through the cracks, but they can damage your credit just as much as larger ones.

Communicate with creditors during difficult times. If you’re facing temporary financial hardship, contact your credit providers before you miss payments. Many have hardship programs that can adjust payment schedules or amounts without damaging your credit.

Understanding Special Situations

Sometimes your credit score drops even when you’ve been paying on time. This can happen if you’ve applied for several new credit accounts recently, closed an old account that shortened your credit history, or maxed out your credit cards.

You can have a credit score without loans. Your score can be influenced by utility accounts, phone contracts, and Buy Now Pay Later services, which are now reported to credit bureaus as of January 2025.

Having no credit history is different from having a bad credit history, but both present challenges. Lenders prefer to see evidence of how you’ve managed credit in the past. People new to Australia or young adults just starting their financial lives often have limited credit files. Building credit from scratch takes time, but it can be done strategically. Start with a low-limit credit card, pay it off in full each month, and keep utility and phone bills in your name.

If Your Identity Has Been Used Fraudulently

If you notice accounts or applications on your credit report that you didn’t authorise, take action right away. Contact the credit bureau to report the fraud. You should also contact the Australian Cyber Security Centre through their ReportCyber website and your local police to file a report.

Request that a ban be placed on your credit file to prevent new credit applications while the fraud is investigated. This stops fraudsters from opening more accounts in your name.

Contact the credit providers associated with the fraudulent accounts directly. Inform them that you’re a victim of identity fraud and didn’t authorise the accounts or applications.

Lodge a complaint with AFCA if the bureau or lender doesn’t resolve the issue satisfactorily. Keep detailed records of all communications, reports, and evidence.

Can You Still Get Approved for a Loan With Bad Credit?

Yes, you can still get approved for a loan with bad credit, but your options are more limited and more expensive. Some lenders work with bad credit but charge much higher interest rates, sometimes 20% or more. These high rates can trap you in a cycle of debt if you’re not careful.

Secured loans, where you provide collateral like a car or savings as security, are easier to get approved for with bad credit. The lender has less risk because they can claim the collateral if you don’t pay.

You might need a guarantor, someone with good credit who agrees to be responsible for the loan if you can’t pay. Parents or close family members sometimes act as guarantors.

Credit unions and community banks sometimes have more flexible lending criteria than major banks. They may look at your full financial situation rather than just relying on your credit score.

The best approach is to work on improving your score before applying for major loans. Even six months of consistent on-time payments can make a difference in the rates and terms you’re offered.

Final Thoughts: You’re Not Alone on This Journey

Your credit score is just a number that reflects your financial habits. It’s not a measure of your character or your worth as a person. If your score is low right now, that’s okay. It’s a starting point, not a destination.

Thousands of Australians work to improve their credit scores every year. Some are recovering from financial hardship. Some are correcting errors they didn’t know existed. Some are simply learning about credit for the first time. Whatever your situation, you’re in good company.

Small actions add up: paying bills on time, keeping balances low, and checking your report regularly. These simple habits build strong credit over time.

Change won’t happen overnight. You might not see dramatic improvements in the first month. But if you stick with good habits, you’ll look back in six months or a year and see real progress. That progress opens doors: better interest rates, higher credit limits, loan approvals, and the confidence that comes with financial stability.

If you’re feeling overwhelmed or stuck, remember that help is available. Easy Credit Repair works with Australians who need support correcting errors, understanding their rights, and rebuilding their credit profiles. We operate within Australian credit laws to provide transparent, professional guidance through lawful processes.

Whether you’re starting with a low score or protecting a strong one, you have the power to shape your financial future. Understanding your credit score is the first step. Taking action is the second. And we’re here to walk alongside you through both.

Schedule a consultation today, and let’s work together toward the financial confidence and freedom you deserve.

Disclaimer: All the information in this guide is based on research and our views only. If you have questions or need personalised advice, please reach out to us.