Your credit score affects whether you qualify for a home loan, car finance, or even a new credit card. If you’ve been turned down or offered higher interest rates than expected, you’re not alone. Many Australians face the same frustration, unsure where to begin or what truly makes a difference.

Improving your credit score comes down to consistent habits over time. Paying bills on time, reducing credit card debt, correcting errors on your report, and avoiding unnecessary credit applications form the foundation. Most Australians see genuine results within six to 12 months when they follow the right steps. This guide walks you through exactly what to do, how long it takes, and when professional help might be worth considering.

Key Takeaways

- Check all three credit reports from Equifax, Experian, and Illion — corrections to errors can improve your score within 30 days

- Pay all bills on time; even one late payment over $150 stays on your file for two years

- Keep credit card balances below 30% of your limit to show lenders you’re not relying heavily on credit

- Avoid applying for multiple loans or credit cards in a short period — too many hard inquiries signal financial stress

- Most Australians see meaningful improvement in six to 12 months with consistent effort, though defaults take up to five years to clear

Before You Start: What You Need to Check First

Review All Three Credit Reports

You can’t fix what you don’t know about. Request a free copy of your credit report from each of the three major credit bureaus in Australia: Equifax at mycreditfile.com.au, Experian at experian.com.au, and Illion at checkyourcredit.com.au. You’re entitled to one free report every three months from each bureau under Australian law.

Your reports may differ slightly between bureaus because not all lenders report to all three. Checking all three gives you the complete picture. Look for outdated information, duplicate listings, or accounts you don’t recognise. These errors are more common than most people realise, and fixing them can give your score a quick boost.

Identify What’s Holding You Back

Once you have your reports, review them carefully. Common issues that drag scores down include missed payments listed incorrectly, defaults that should have been removed, credit card balances sitting over your limit, and too many hard inquiries from recent credit applications. If you’re wondering why your credit score isn’t improving even after paying bills, outdated or incorrect information might still be appearing on your file.

Make a list of what needs fixing. This becomes your roadmap — whether that means disputing errors, paying down debt, or committing to on-time payments moving forward.

Step-by-Step: How to Improve Your Credit Score

Step 1: Pay All Accounts on Time, Every Time

Your payment history carries the most weight with lenders. Late payments over $150 that are 60 days or more overdue get listed on your credit file and stay there for two years. This is the single biggest factor in whether your score rises or falls.

Set up direct debits for minimum payments at a minimum. If you’re struggling to cover the full amount, paying at least the minimum prevents a default. Calendar reminders or automatic payments take the guesswork out of due dates and remove the risk of forgetting. Automating payments removes human error and prevents you from missing a due date, which protects your file from unnecessary damage.

Step 2: Lower Your Credit Card Balances

Credit card balances matter more than many people realise. Keeping your usage below 30% of your total limit signals responsible management to lenders. If you have a $10,000 credit limit, aim to keep your balance under $3,000. Going below 25% is even better.

Paying down balances improves your credit position and saves you money on interest. If full repayment isn’t possible right away, target the highest-interest cards first or make mid-cycle payments to lower reported balances. Paying in full each month shows lenders that you can manage credit without relying on it long-term.

High utilisation suggests you’re stretching financially, which makes lenders nervous. Low utilisation suggests you have control over your spending.

Step 3: Correct Credit Report Errors

Errors happen. A debt might be listed twice, payment amounts could be wrong, or a default might appear even though you were in dispute with the creditor. If you spot an error, contact the credit bureau first — they may fix it immediately or investigate on your behalf.

If the error involves a credit provider, reach out to them directly and ask for the incorrect listing to be removed. If they agree it’s wrong, they’ll instruct the credit bureau to update your file. If you can’t resolve it, escalate to the Australian Financial Complaints Authority at afca.org.au for free, independent dispute resolution. Most disputes are resolved within 30 days.

If the default is genuinely incorrect and you can prove it, removal can happen within one to three months once the dispute is resolved. If it’s accurate, it stays for five years regardless of whether you pay it off.

Step 4: Avoid New Credit Unless Necessary

Every time you apply for a loan or credit card, a hard inquiry appears on your report. Too many inquiries in a short time suggest you’re under financial pressure, which can lower your score. Each hard inquiry can temporarily lower your score, and multiple inquiries within a few months can make lenders hesitant to approve you.

Research your options and only submit applications where you’re confident of approval. Space out applications by at least three to six months if possible. If you’re comparison shopping for a home loan, try to keep all inquiries within a two-week window, as most credit scoring models treat them as a single inquiry when they’re close together.

Step 5: Keep Long-Term Accounts Open

Closing old credit cards might seem like a smart move, but it can hurt your score. The length of your credit history matters — longer histories build trust with lenders. If an account has no annual fee, consider keeping it open and using it occasionally for small purchases to maintain activity.

In most cases, keeping old accounts open is better. Closing accounts also reduces your total available credit, which can push your credit utilisation ratio higher even if your spending stays the same.

Step 6: Monitor Your Score Regularly

Checking your credit score quarterly helps you track progress and catch new errors early. Many Australian banks including Commonwealth Bank, NAB, and Westpac offer free credit score monitoring. You can also use platforms like Credit Simple or Finder.

Checking your own score is considered a soft inquiry and has no impact on your credit file. Regular monitoring keeps you aware of what’s affecting your score and lets you adjust your approach as needed. The safest method is to use the official credit bureau websites or reputable Australian financial services that offer free access.

Fast but Safe Ways to See Quick Results

Some strategies can speed up improvement without taking risks. Paying down revolving debt mid-billing cycle can lower the balance reported to credit bureaus, which improves your utilisation ratio faster. If you’ve been managing your account responsibly, requesting a credit limit increase without taking on new debt can also lower your utilisation percentage.

If you’ve paid off a default, you can sometimes negotiate with the creditor to have it removed from your file, though they’re not obligated to do so. Becoming an authorised user on a trusted family member’s account with a strong payment history can help, though this option is less common in Australia than in other countries.

The fastest way to raise a low credit score combines several actions: correcting errors immediately, paying down high balances, and staying current on all payments. There’s no single trick, but combining these steps produces the quickest safe results.

Smart Credit Card Strategies for Better Scores

The way you use your credit card directly affects your score. Keep your balance below 30% of your limit at all times — staying closer to 10% produces even better results. Making small purchases monthly and paying them off in full shows active, responsible use.

Avoid balance transfers unless they genuinely reduce your total utilisation and you’re confident you can pay off the transferred amount within the promotional period. Always pay before the due date — even paying on the due date risks delays that could result in late fees or missed payment marks.

Paying off debt early improves your score, but the improvement shows up gradually rather than instantly. Credit bureaus update your file monthly, so it can take one to two billing cycles before the change reflects in your score.

A client from Perth improved their score by 110 points in six months simply by keeping their credit card balances below 25% and paying in full each month. Small, consistent actions compound over time.

The answer isn’t about the number of cards — it’s about how you manage them. Having three or four cards with low balances and on-time payments is better than having one card maxed out. The key is utilisation and payment history, not the number of accounts.

What Not to Do When Trying to Improve Your Credit Score

Certain actions can set back your progress. Closing old credit cards shortens your credit history and reduces your available credit, which can hurt your score. Instead, keep accounts open with occasional small purchases.

Applying for multiple loans at once creates too many hard inquiries and signals desperation to lenders. Wait three to six months between applications.

Paying only minimum amounts prolongs debt and increases interest costs. Pay as much as possible above the minimum to reduce balances faster.

Ignoring small overdue bills is a common mistake. They can turn into defaults if left unpaid. Set reminders for all accounts, no matter how small.

Using generic dispute templates when challenging errors may trigger rejection by credit bureaus. Write personalised, factual disputes with evidence. Generic templates are easy to spot and often dismissed.

While paying only the minimum prevents missed payments, it keeps you in debt longer and costs more in interest. Paying more than the minimum whenever possible speeds up debt reduction and improves your credit position faster.

Recovering from Late Payments or Defaults

Late Payments

Late payments are recorded when you’re 60 days or more overdue on a debt of $150 or more. They stay on your file for two years. Consistent on-time payments after a late payment can start reversing the damage within six months.

If you’ve missed a payment, get current as soon as possible and stay current moving forward. The impact of past problems fades as your recent payment history improves. The impact depends on how late you were and your overall payment history, but even one late payment can drop your score by 50 to 100 points initially.

Scores do recover. It takes time and consistency, but six months of perfect payments can significantly reduce the impact of an earlier mistake.

Defaults

A default is listed when a debt remains unpaid and the creditor officially reports it. Defaults stay on your credit file for five years from the date they’re listed, even if you pay them off.

If a default was listed incorrectly — for example, you were in dispute with the creditor or they didn’t notify you properly — you have the right to challenge it. Contact the credit provider first, and if they don’t resolve it, escalate to AFCA.

Paying off a default won’t remove it from your file, but it will update the status to “paid,” which looks better to future lenders. Defaults have the most impact in the first year or two, and their effect gradually decreases over time as you build positive payment history.

Debt Consolidation Option

If you’re juggling multiple debts and struggling to keep up with payments, consolidating them into a single loan can help. This simplifies repayment and can reduce the risk of missed payments, which protects your credit file over time.

Debt consolidation works best when it lowers your overall interest rate and you commit to not taking on new debt while paying it off. It can help improve your score, but only if it leads to better payment behaviour and lower overall utilisation.

Building Credit When You Have No History

If you’re new to credit in Australia, starting from scratch can feel slow. Begin with a low-limit credit card and use it for small, regular purchases that you pay off in full each month. This demonstrates responsible behaviour without putting you at risk of high debt.

Adding your name to household bills like utilities or internet can also help establish a payment history, though not all providers report to credit bureaus. Start early and be consistent. Even small, positive actions build a foundation that lenders will recognise when you apply for larger credit products later.

Most credit improvement doesn’t require professional help — it requires discipline, consistency, and time. Professional services are helpful when errors are persistent or disputes are complex, but day-to-day improvement is something you can manage yourself.

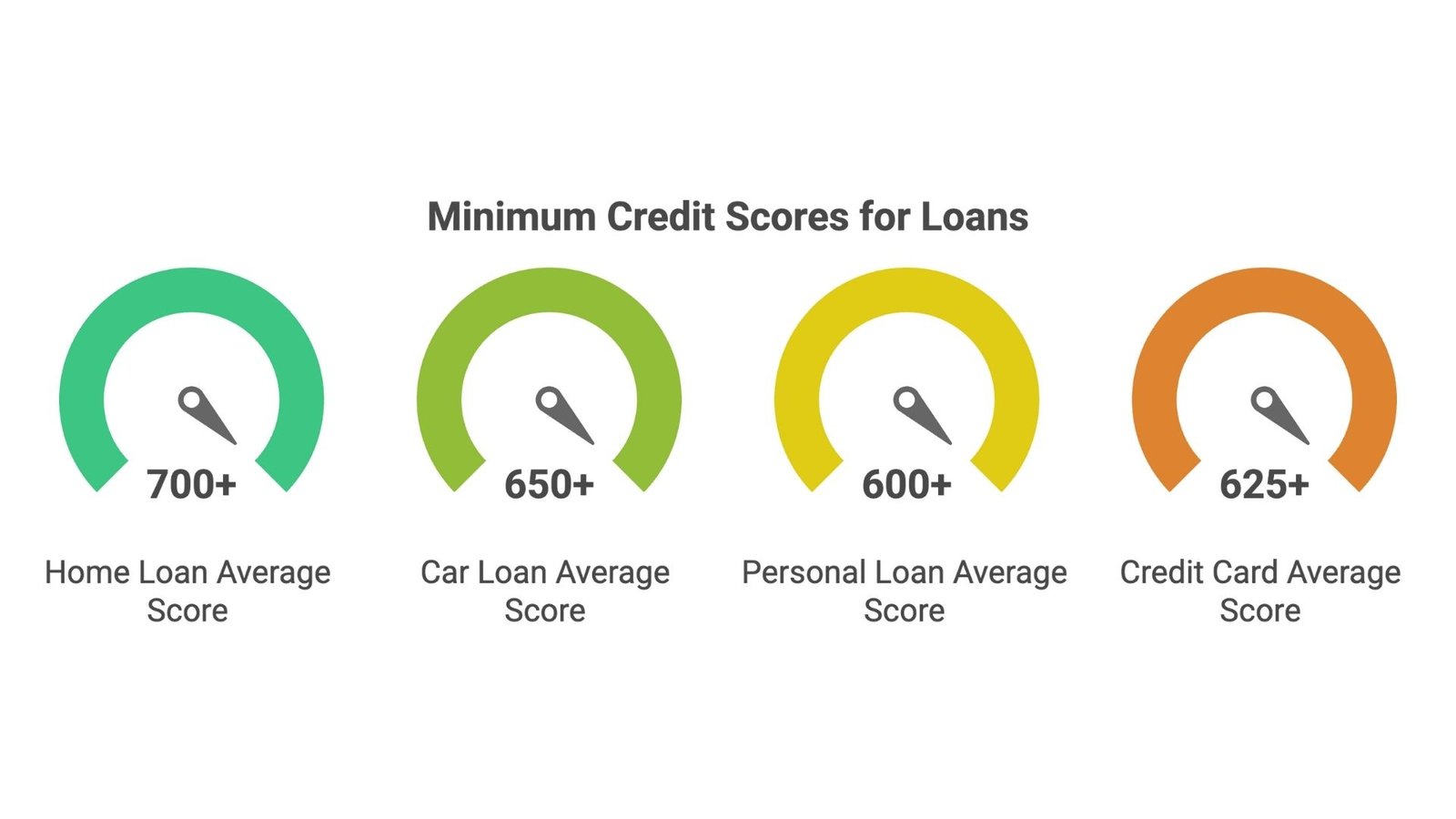

How Lenders View Your Credit Score in 2026

Your credit score matters, but it’s not the only thing lenders consider. They also look at your income, employment stability, existing debts, and spending patterns. A higher score gives you better chances of approval and access to lower interest rates.

Lenders in 2026 are placing more weight on repayment consistency and overall financial behaviour, not just the number itself. Even if your score isn’t perfect, a strong pattern of on-time payments and responsible credit use can still work in your favour.

What lenders look for includes credit score, payment behaviour, employment history, debt-to-income ratio, and how long you’ve held accounts. Lenders want to see stability and reliability.

Australian Consumer Rights When Repairing Credit

You have clear rights under Australian law when it comes to your credit file. You can access your credit report for free every three months from each credit bureau. If you find errors, you can dispute them under the Privacy Act 1988, and credit providers must respond within 30 days.

If a dispute isn’t resolved, escalate to AFCA at afca.org.au or the Office of the Australian Information Commissioner at oaic.gov.au for free, independent support. You can also seek help from free financial counselling services, which won’t affect your credit score.

Professional credit repair services operating in Australia cannot legally remove accurate listings from your file. Any service promising to remove legitimate defaults or late payments is misleading you. If something is on your file and it’s accurate, it stays for the designated period.

You can fix incorrect credit listings yourself by contacting the credit bureau or provider directly, or you can work with a professional service that operates transparently under Australian law. Make certain they’re not making false promises.

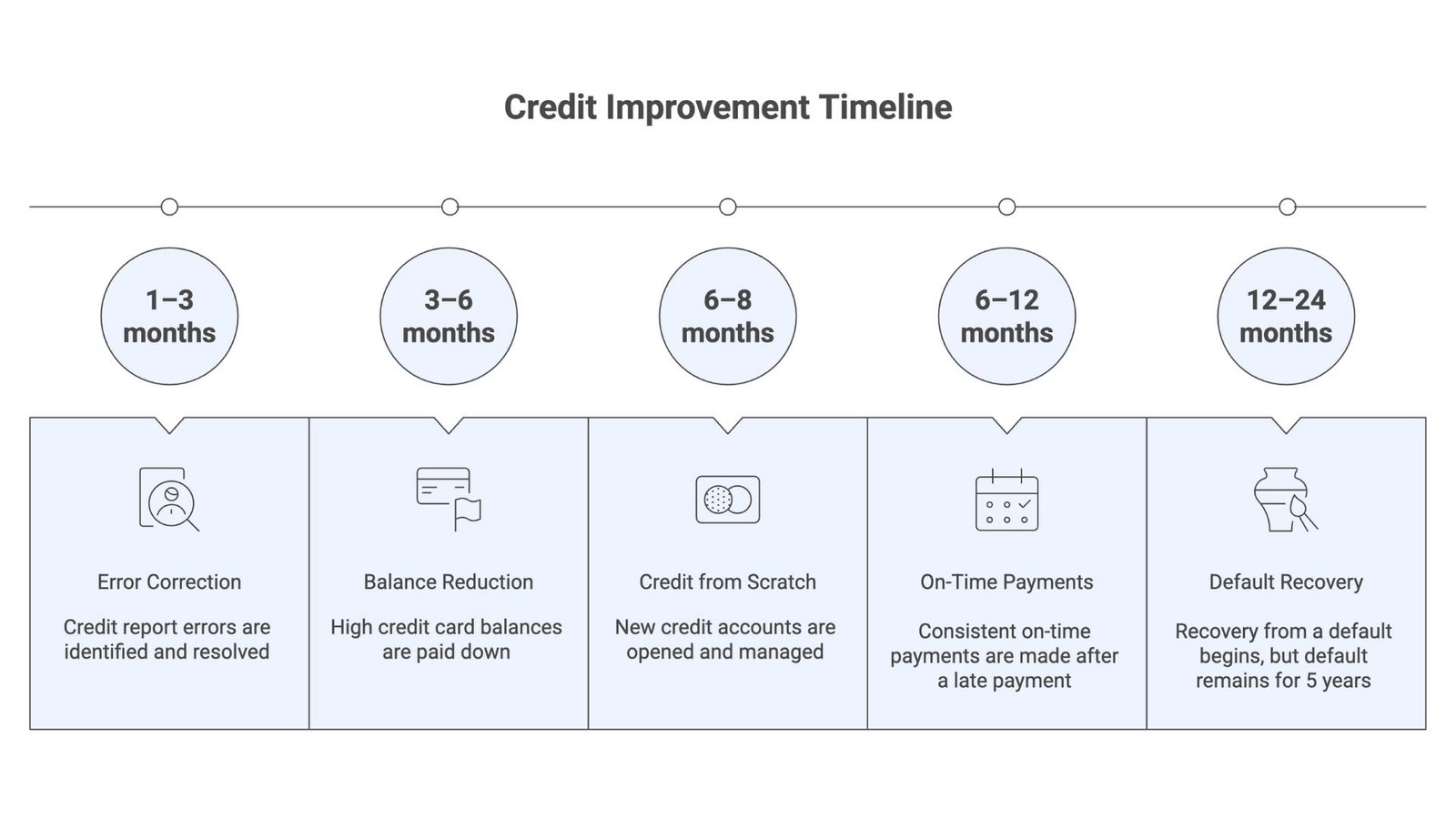

How Long Does Credit Improvement Take?

The timeline depends on what’s holding your score back. Minor corrections like fixing an error or updating personal details can happen within one to three months once the dispute is resolved.

If you’re recovering from late payments, expect to see noticeable improvement within six to 12 months of consistent on-time payments. Paying down high credit card balances can show results in as little as three to six months.

Defaults take longer. While the default itself stays on your file for five years, the negative impact reduces over time as you build positive payment history. Most people see meaningful recovery within 12 to 24 months if they stay current on all accounts.

Building credit from scratch usually takes six to eight months of responsible use before your score reaches a level that opens up better lending options.

How long it takes to fix a bad credit score depends on the severity of the issues and your consistency moving forward. There are no shortcuts, but there are clear pathways. Significant improvement usually takes longer than a month, but correcting a major error or making a large debt payment can produce noticeable changes within one to two months.

Real-Life Examples of Credit Score Improvement

A client from Sydney had two defaults cleared after successfully disputing them with the credit provider. Within six months, their score increased by 180 points, allowing them to qualify for a home loan they’d previously been denied.

Another client with no credit history started with a low-limit credit card and made small monthly purchases, paying in full each time. After eight months of consistent use, their score reached 710 — enough to secure a car loan with competitive interest rates.

A Melbourne-based client reduced their credit card balances from 80% utilisation to under 25% over four months. Their score improved by 95 points, and they were able to refinance an existing loan at a lower rate.

These examples show that improvement is possible when you take targeted, consistent action. If you’re dealing with persistent errors, unresponsive creditors, or complex disputes across multiple bureaus, professional help can save time and stress. The key is to work with a service that operates legally and transparently.

When to Get Professional Help

If you’ve disputed errors multiple times and they’re still not corrected, professional credit repair may be worth considering. The same applies if you’re dealing with discrepancies across multiple credit bureaus or if creditors aren’t responding to your requests.

Professional services can also help if you’re facing ongoing loan rejections despite what seems like good financial behaviour. Sometimes the issue is buried in your credit file and requires expert review to identify.

If you decide to seek help, make certain the service operates transparently under Australian law and never promises to remove accurate information. Honest services will tell you what they can and can’t do upfront.

Tools and Resources

- Equifax: mycreditfile.com.au

- Illion: checkyourcredit.com.au

- Experian: experian.com.au

- AFCA: afca.org.au

- Moneysmart: moneysmart.gov.au

- OAIC: oaic.gov.au

Frequently Asked Questions

How quickly can I raise my credit score?

Minor improvements like correcting errors can show results in one to three months. Consistent payment behaviour typically takes six to 12 months to produce meaningful change.

Will paying off debt instantly increase my score?

Paying off debt helps, but the improvement isn’t immediate. Credit bureaus update your file monthly, so it can take one to two billing cycles before the change reflects in your score.

Can I improve my score without taking new loans?

Yes. Paying bills on time, reducing credit card balances, and correcting errors all improve your score without requiring new credit.

What’s the best way to recover from defaults?

Focus on staying current with all payments moving forward. Defaults remain on your file for five years, but their impact lessens as you build positive history.

Is professional credit repair worth it?

If you’re dealing with persistent errors, unresponsive creditors, or complex disputes across multiple bureaus, professional help can save time and stress. Just make certain the service operates legally and transparently.

Final Thoughts

Improving your credit score in Australia doesn’t require perfection — it requires consistency. Start by checking your credit reports, correcting errors, and committing to on-time payments. Lower your credit card balances, avoid unnecessary credit applications, and monitor your progress regularly.

Most Australians see real improvement within six to 12 months when they stick to these habits. Defaults and serious issues take longer to overcome, but progress is still possible with patience and the right approach.

If you’re struggling with errors, disputes, or ongoing rejections, professional support can make the process easier. Easy Credit Repair works with clients across Australia to help them navigate credit challenges under Australian law — transparently, without false promises.

Ready to take control of your credit? Schedule a consultation at easycreditrepair.com.au to discuss your situation and explore your options. We’ll review your credit file, identify what’s holding you back, and create a clear plan to move forward.

Disclaimer: All information in this guide is based on research and our views only. If you have questions or need personalised advice, please reach out to us.